by Ryan | Sep 13, 2016 | Design News, Procurement and Purchasing, Project Management

So much of what r.o.i. Design does is deliver the products that complete the design. We want to fulfill the promise we make during the design process. That is a full-time job for a patient, persistent, inquisitive and organized person.

Ronda Geyer joined us this year in the role of Products and Procurement Manager. She describes her job as the “Manager of Stuff”. She comes to r.o.i. Design with experience in product sales, interior design, landscape design and project management. Her challenge is to juggle the totally unique nature of each job and their corresponding variety of suppliers and vendors. No two jobs are alike, nor use the same resources, or have the same budget.

“Last month I was shipping product to Virginia, Indiana and Michigan,” Ronda described. “I want to make our customers happy and we work very hard not to disappoint them, which most often comes down to managing expectations and real time communications. I am getting better and better at it.”

by Mary | Dec 6, 2015 | Design News, Hospitality Design, Project Management

Remodeled Bathroom (Image from laterooms.com)

It isn’t easy to be cool. And hospitality design is a cutting edge market. A national hotel brand knows design and technology are key factors in property improvement plans.

Properties that want to maintain their status with a national hotel brand undergo regular inspections to make sure their property meets the standards of the brand. During the recession a few years ago, there was some leniency in compliance, but since 2011 national brands are less likely to look the other way. There has been a conscious attrition of properties by the savvy big names who know that they have to compete in each market by scrutinizing and discerning customers.

Today’s customers are technically plugged-in. They are informed and that doesn’t give a hotel property much wiggle room when it comes to meeting expectations. National brand websites promote an experience that needs to be delivered whether in Anchorage or Miami.

Hotels that want to establish a relationship with a national hotel brand have a rigorous review. Existing hotels that haven’t updated their properties in the last 3-5 years are being challenged by the costs related to required updates.

The areas that challenge the existing property and could be higher priorities on a PIP (Property Improvement Plan) include:

Technology

- From registration to check in, in-room stay and checkout, the customer expects to control their experience through their online capabilities.

- In-room TV’s are monitors with streaming TV, and customer access to their business and personal sites needs to be immediate.

In-room services

- Customers want the ability to make their home for a night meet their needs. Whether that means writing a business report, taking along a pet, eating in, exercising in or conducting a virtual business meeting.

Interior design

- If properties haven’t updated since 2011, they are faced with changes in customer expectations in lighting, bedding, finishes and furnishings (in that order).

Property services

- Not that long ago the pool and fitness center was a “must have”, and while still preferred for general business and personal accommodations, it is out-ranked by giving the guest enough room in their room to be able to exercise. Resort hotels still need fitness centers, pools and spas.

- While today’s guest doesn’t need a real front desk, they do need at least the ability to find a small meal, a beverage, the equivalent of a local concierge or “helper”.

Hotel developers who are building today, find the requirements by a national hotel brand to be both more specific and strict, but also more consultative. Brands are very eager to have strategically placed and built properties and those requirements come with costs, so most hotel companies want to appear to be and in most cases, be helpful.

r.o.i. Design is seeing an emerging trend in national hotel brands that further separates those properties from the boutique hotels and the resort hotels. The boutique and resort hotels are able to provide unique style and services based on a developer or regional preference. Customers are discerning and are deciding if their stay requires a national brand, a boutique hotel or a resort experience.

by Mary | Oct 13, 2015 | Hospitality Design, Interior Design, Procurement and Purchasing, Project Management

With the increase of new hotel and resort projects, as well as robust remodeling, owners and construction project managers are re-examining how they fulfill the millwork and casegood category of their building projects.

r.o.i. Design describes millwork as casegoods that are fixed to the architecture. Casegoods (typically described in the furniture category) and millwork are amortized differently on the balance sheet and quite often supplied by different sources. This area of procurement is a challenge but also an opportunity.

Aside: The debate about buying US or non-US continues, but the more foreign manufacturers merge their offering with state side distribution, the point of manufacturing is becoming less of a political, economic issue. We all need each other, globally to make our businesses work, within reason. Logistics and the chain of ownership continues to be the defining component to value and control.

r.o.i. Design can contribute to this dialogue with these observations:

- Understanding: When the customer understands that the total cost of a product includes, freight, handling, staging and delivery-the criteria may change. The age old mantra, “you can have 2 of the 3 – 1. design, 2. price or 3. schedule” still holds true.

- Flexibility: And when the project team is willing to look at qualified suppliers outside their list of typical vendors, value can be realized.

- Cost Analysis: Overseas products may show up with a reduced unit price, but the cost and risk to get those products to the site, as designed and on time is not always as manageable. We see this situation being improved incrementally and by situation, but as of October 2015, we don’t make price or lead time promises on overseas product without considerable confirmation and agreement.

- New Materials and Technology: While process and manufacturing styles for US manufacturers are consistent, their emerging ability to use new materials and technology are offering a value that competes with the “all in costs” of overseas manufactures.

- Design-Assist: When project budgeting can take advantage of qualified suppliers, early in the process, value is realized. Sharing the designing of products with the makers of the products only makes sense to our customers.

Textured Melamine

New Materials

In the last few years, r.o.i. Design has specified “new materials” with great success.

- Textured melamine panel products offer a huge advantage for larger projects.

- The big names in laminate (Formica, Wilsonart, Pionite and Nevamar) have done there homework and laminate, an affordable option, is becoming a more viable option to wood or stone in today’s designs.

- And the combined use of solid surface veneer with laminates has created options for look and feel not available even a year ago.

- Upholstered casegoods are a viable option. Technology and design has created a category of fabric that defies wear, responds to robust cleaning and is easily replaceable. Fabrics are merging with hard surface options.

r.o.i. Design has it roots in manufacturing for hospitality and while we only have a sample shop today, our interest, relationships and experience in casegoods and millwork continue to bring value to our customers.

We negotiate with our customers and their contractors to determine how we best can bring value to their millwork and casegood procurement.

by Mary | Oct 7, 2015 | Construction, Design News, Interior Design, Project Management

Where do you learn about drones, BIM, Design-Assist? Turns out at the Fall COAA Workshop in Novi, Michigan.

Over 75 construction and design professionals gathered for a day of learning and networking in September 2015. Mary Witte, from r.o.i. Design attended.

The second session of the day was a presentation by three members of COAA, an owner, an architect and an contractor. This was a candid discussion of the process of building the team that determines the design, the cost and the timeline for buildings.

For r.o.i. Design, their comments about pre-qualifying team members through a RFQ (Request for Qualification Process) made a lot of sense and we understand how this step potentially saves the owner/project a considerable amount in fees. The presenters suggested that a large RFP (Request for Proposal) process could involve over 10,000 hours in professional time and still doesn’t guarantee best outcomes. They asked they question, “What can we take from the interviewing and bidding process to add value to the job?” Owners are living with a project long after the architect and contractor are gone, the decision who is on the team has a legacy implication. Start with clear understanding of what is important to the owner and let that drive the process of assembling the best team for the job. (Presenters: Leisa Williams-Swedberg, construction Administrator, Michigan State University, Nick Salowich, Principal, Science & Technology Studio Leader, Smith GroupJJR, Robert LaLonde, LLED AP, Vice President Clark Construction).

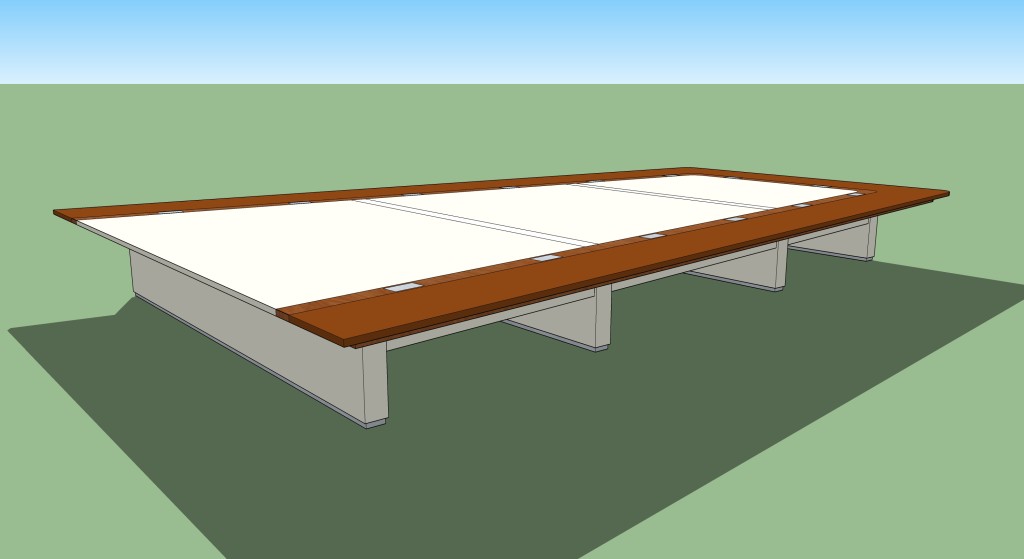

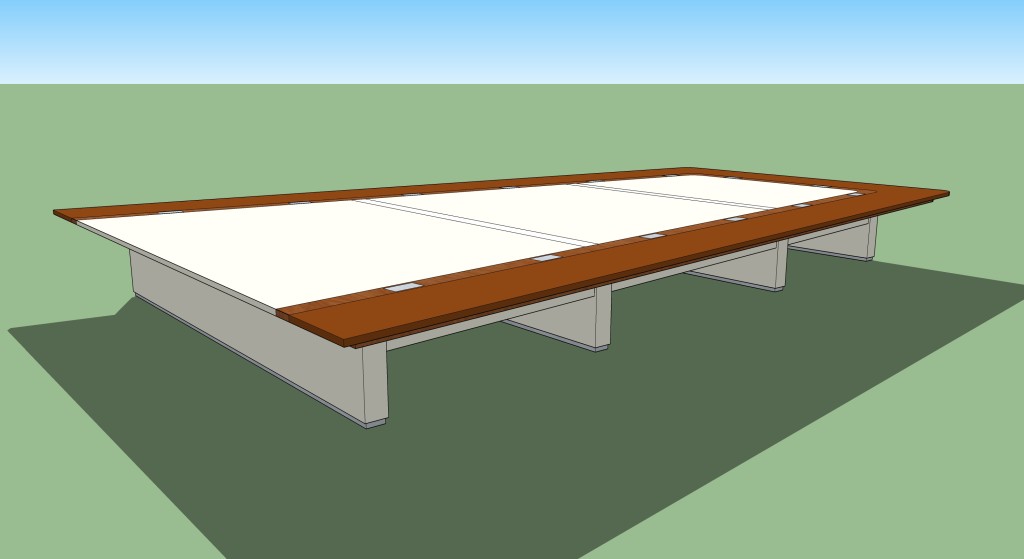

r.o.i. Design Pre-Design Rendering

Target Value Design (IPD-Integrated Product Delivery) was the topic of the third session.

This group of presenters, again from different disciplines, highlighted a process that, in r.o.i. Design’s view, was advocating for integration of the builders & makers into the budget and design process much earlier than the traditional model. (That model being: Concept, Design, Develop Design, Schematic Design, Construction Documentation 75%, 90% etc. ). This group asks the question, why does there need to be value engineering, why not value designing-real time analysis that is meaningful.

Whether designing a building or a table, consider bringing in the makers early in the process. Custom conference table designed by r.o.i. Design.

This discussion raised our awareness that designers have an opportunity to serve our clients by promoting a new process: Create 3-D illustrations to describe design intent to such detail that all related trades can begin to work on documents that build the design in a collaborative and integrated way. This also raised the concern on how designers would be compensated for their ideas, which began a discussion on the true nature of team. (Presenters: Anthony Bango, Vie President Project Planning, The Christman Company; Matt Cramer, President, De Cramer Inc; Kevin Kershbaum, HGA Architects)

r.o.i. Design understands that designers bring the greatest value to owners in two ways- creativity and management. Clearly describe the concept that meets the expectations and needs of the customer, and then manage the process. That doesn’t mean making every decision, drawing every schematic or trying to be the expert.

The final presentation felt like a continuation of the previous discussion, but with more “math”.

Design-Assist is a method of design-to construction that also engages contractors early in the process of planning. The presenters introduced the idea of all participants in a project to consider themselves “partners”. That would mean share the savings, share the profits, and be transparent with the opportunity for improvements. Any conflict over who owns ideas and solutions has no room in a design-assist process. This discussion looked at the opportunity to avoid “waste”: duplication of services, postponing decisions or making half decisions on half the information. This discussion gave us insight into an opportunity to develop respect and trust among team members. We are all conditioned and comfortable with our process, change is hard, but the future of construction has to be LEAN. (Presenters: Victor Sanvido, Senior Vice President, Southland Industries; George Karidis, PE, LEED AP BC+C, vice President, Corprate Engineer for Scince & Technology, SmithGroup JJR)

GVSU Marketplace Mary Jane Caster, Mary Witte, (Designers) and Carol Cool (GVSU Project Manager)

From Mary Witte: Through the day, I reflected on the r.o.i. Design “Budget, Brand and Beauty” story and was excited that our choice of practice is on track with the trends in our industry. Start with the owners values and interpretation of quality, develop a team, share all the information with the team, create process and structures that are inclusive and helpful, trust your team and ask them to trust you.

**

r.o.i. Design has been working with Grand Valley State University since 2009 and through that work we discovered COAA. We have been impressed with the people and the quality of the information presented by and to the membership. It is a national organization with State Chapters. The Michigan Chapter presents two workshops a year, promotes their national training programs and encourages its members to attend the National Convention. We are proud members of COAA. www.coaa.org

r.o.i. Design has been working with Grand Valley State University since 2009 and through that work we discovered COAA. We have been impressed with the people and the quality of the information presented by and to the membership. It is a national organization with State Chapters. The Michigan Chapter presents two workshops a year, promotes their national training programs and encourages its members to attend the National Convention. We are proud members of COAA. www.coaa.org

by Mary | Aug 17, 2015 | Design News, Interior Design, Project Management

GVSU Marketplace Designers and Owners

r.o.i. Design knows that the customers experience of the design-build process will predict whether or not they will love their new space. It is so much more than having the perfect design or the “expert consultant” on the job.

When there is a great design-build team the outcome has a much greater chance of meeting and exceeding customer expectation of the finished product. There aren’t layers of concern and stress laid on top of the customer-team relationship, making the customer suspect and wary if they are going to get what was promised them or not.

A great design team also means efficiency which saves everyone budget dollars.

- When there is trust between team members it accelerates the customer’s confidence in all recommendations where ever they come from.

- When simple oversights are managed before they become a crisis or trigger change orders, customers are saved the awkward experience of finger pointing between team members.

- Real time communication is ongoing and a shared responsibility between owners, designers and contractors that is supported by protocol documentation verses solely relying on “the system”.

- Trust creates an attitude of flexibility in the process which allows great ideas and solutions to surface anytime in the process. When a design criteria is well understood and all parties buy in, it is only ego that keeps good ideas from being executed.

r.o.i. Design strives to be part of great design-build teams. For us that has happened when:

- Jobs we share could have started with any one of the groups, whether it is the contractor’s customer, the architect’s customer or our customer, we communicate to the customer early in the process who the team is and how we would like to work with them.

- Roles on a job are defined and respected, even when the customer challenges the structure, we represent the team.

- Building and maintaining relationships is everyone’s priority.

This week a manufacturing customer, remodeling a floor in their facility to create an innovation center commented to r.o.i. Design, “So you guys actually get along with this construction company. Our last remodeling project was a nightmare – the designer, architect and contractor kept blaming each other. They won’t ever be back.”

by Ryan | Jun 1, 2015 | Design News, Project Management

r.o.i. Design was invited to a COAA Spring Owner Connect Workshop by their customer Carol Cool, now a project manager at Michigan State University but who we met when she managed the GVSU Marketplace project where we designed the GVSU Laker Store.

We were very impressed with the quality of the content, the professionalism of the presenters and attendees and look forward to being more involved.

We were very impressed with the quality of the content, the professionalism of the presenters and attendees and look forward to being more involved.

While all the information presented had value, r.o.i. Design would like to share the highlights from the Ken Simonson’s presentation, “Michigan’s Economic Outlook”, Ken is the Chief Economist for ACG (Associated General Contractors) of America.

Here are the headlines:

Employment

Growth moderately up, more so in metropolitan areas; currently nationally we are at 2008 employment rates. The state of Michigan is up 8.5% from 2014 and our growth is 10th best out of the 51 states. Michigan construction employment is 30% of its peak in 2002. (more)

Concern for qualified construction workers: 83% of construction companies are having trouble finding craft workers, 61% of construction companies are having trouble finding project managers and supervisors.

The hope for construction employment is the local focus on vocational programs and the renewed commitment to training. The increased use of labor saving technology will relieve some of the pain.

Material Costs

- Steel same as 2011 price and declining

- Gypsum up 50% since 2011, 2014 shows some leveling

- Copper/brass down 25% since 2011

- Lumber/plywood up 25% up since 2011, 2014 shows some leveling.

- Concrete and plastics up 10-18% since2011-cement pricing up 9% in 1 year due to tight capacity. More plastic suppliers coming on line so there may be a cost reduction..

- 2015-2017 construction spending estimated to be up 6-10%

Growth areas expected in 2015

Growth areas expected in 2015

- 33% of growth will be based on retail remodeling, warehouse/industrial projects, and lodging.

- 25% of growth in office and office remodeling

- 20% of growth will be manufacturing based.

National trends holding back construction:

There is less government spending which make public school projects “flat”.

Consumers continue to switch to “on line” retailing. There are increasing amount of services that allow consumers to stay home.

- But this does reflect in the amount of warehouse and distribution centers being built to satisfy the real time delivery of on line purchased goods.

- But this has created an active market of re-purposing retail building inventory: converting them to mixed use, office or residential projects.

Employers are shrinking their office spaces. The realization of remote technology has reduced the need to store paper. The realization that not all employees need a full time space in the office has increased the amount of “hoteling” of personnel.

- But is stimulating office remodeling and this will continue through the unforeseen future at least through 2016.

Seniors appear to be aging in place, slowing down the new construction of senior care facilities.

National trends encouraging construction:

Shale-Gale, term that encompassing the mining of natural resources, is driving new construction. Companies are building complexes around exploration and drilling. Michigan’s own “Rover” program is stimulating the development of natural gas fields which will feed industries in Michigan and Canada.

Panama Canal, the remodeling of the canal is shifting container traffic to US coastal ports. The landside connection of this increase of business is stimulating construction in a variety of types of projects.

Multi-family construction has grown 30-60% annually since 2011 and is projected to continue through 2015. Growth in Michigan this year is projected at 1%

- Less college grads find employment, less cash to invest in home buying

- People are waiting longer to get married and have children, paying off college debt.

- Location preferences are moving towards cities, especially to cities with private charter schools for families and lifestyle options for seniors.

- Detroit is seeing an increase in urban living for the first time in a generation.

- Population growth is impacted by immigration; coastal cities are seeing increase in need for apartments.

In 2014

Residential construction is only 48% of its previous peak

Non residential construction grew 4-8% last year-top producers listed in order of dollars spent:

- Power (Pipeline)

- Roads and Highway

- Upper Education(Dropping) (PreK-12 may start to show some investments 2015 forward)

- Commercial Remodeling (Growing) (Retail construction is 50% from 2008 levels, all other commercial is showing the growth)

- Manufacturing (Growing a double digit rates, especially relating to oil and gas)

- Office(Flat)

- Transportation(Flat)

- Health Care (Waning) (New construction is on the decline. Private hospitals are seeing competition in stand alone medical services suppliers as stimulated by the affordable care act. Off-site medical office building is on the rise.)

- Sewage(Waning)

- Amusement & Recreation(Waning)

- Lodging (Waning), (Lodging was up 19% in 2014 but hotel growth is estimated to continue to 2015 and then wane. Rev/Par rising each of the last 5 years but investors are skid dish. Student housing has influenced the lodging numbers on the upside.)

COAA: Construction Owners Association of America supports project owners’ success in the design and construction of buildings and facilities through education, information and developing relationships within the industry.

We were very impressed with the quality of the content, the professionalism of the presenters and attendees and look forward to being more involved.

We were very impressed with the quality of the content, the professionalism of the presenters and attendees and look forward to being more involved. Growth areas expected in 2015

Growth areas expected in 2015